Incentive programs

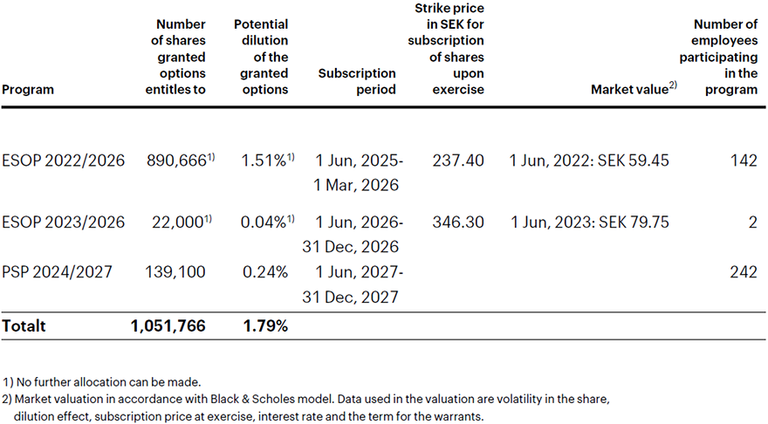

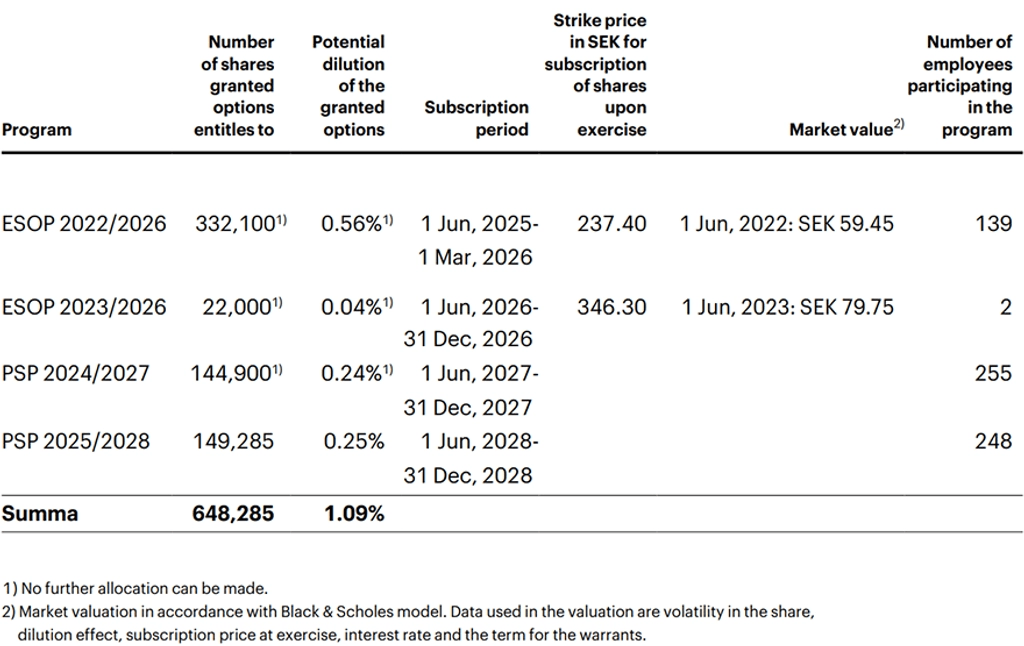

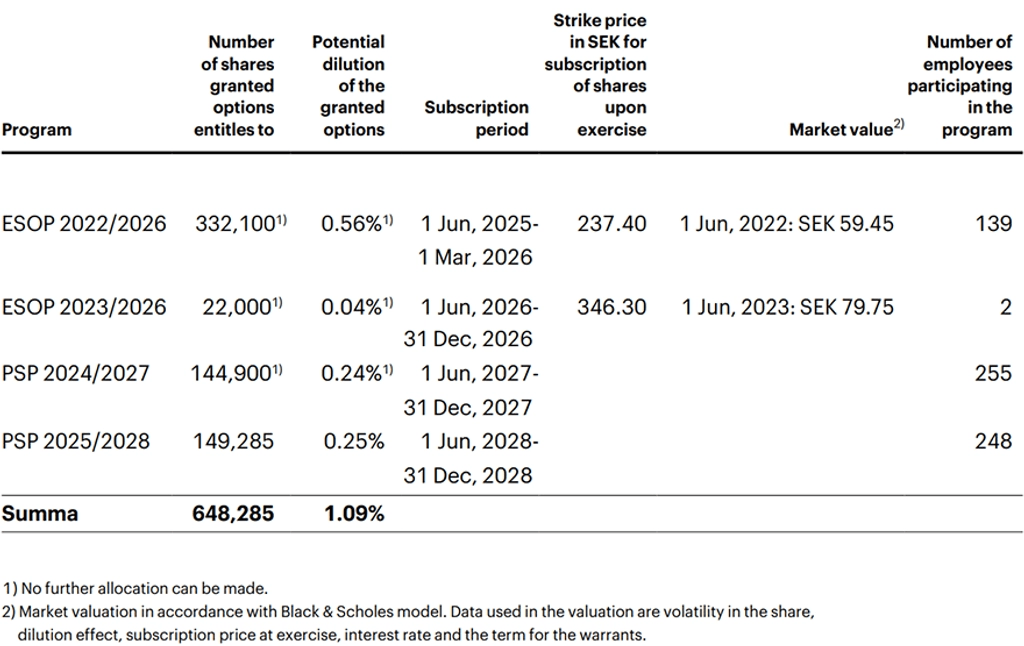

Camurus has two Employee Stock Options Programs (ESOP) active for the company´s employees and one Performance Share Plan. The programs were adopted by the Annual General Meeting (AGM) in 2022, 2023 and 2024. The page will be updated shortly to reflect the AGM 2025 resolution on a new program.

Employee option program

The options are granted free of charge and have a term approximately between three and four years from the grant date. Once vested, the options can be exercised during the exercise period provided that the participant is still employed. Each vested option gives the holder the right to acquire one share in Camurus at a pre-defined price corresponding to 125 or 130 percent of the volume-weighted average price for the company’s share on Nasdaq Stockholm during the ten trading days immediately following the respective company’s AGM in which the program was adopted.

The ESOP 2022/2026 comprises a maximum of 1,000,000 employee stock options, and the ESOP 2023/2026 program comprises a maximum of 200,000 employee stock options.

The fair value of the service that entitles to the allotment of options through the program is reported as a personnel cost with a corresponding increase in equity. The total amount to be expensed is based on the fair value of the employee stock options granted, including the share target price, and that the employee remains in the company’s service during the exercise period. The total cost is reported over the vesting period. At the end of each reporting period, the company reconsiders its assessment of how many options are expected to be exercised and the difference is reported in the income statement and a corresponding adjustment is made in equity. As a basis for allocating social security contributions, a revaluation of fair value is continuously made for the employee stock options earned at the end of each reporting period. Social security contributions are reported as personnel costs and the corresponding provision is made under long- or short-term liabilities depending on the remaining term.

In total 912,666 employee options remain outstanding since the launch of the programs, of which

42,000 are granted to the CEO and 159,500 to other senior executives.

Performance Share Plan

The Annual General Meeting 2024 resolved, in accordance with Camurus’ Board’s proposal, on implementation of a Performance Share Plan 2024/2027 as well as delivery arrangements in respect thereof by way of resolution on amendment of the articles of association, resolution on a directed issue of a maximum of 240,000 redeemable and convertible series C shares, authorization for the Board of Directors to resolve on the repurchase of all issued series C shares and resolution on transfer of a maximum of 185,000 own common shares to the participants of the program.

The Performance Share Plan comprise all employees in the Camurus group and entails an opportunity, after a three-year vesting period, for Camurus’ employees to receive performance shares free of charge, subject to satisfaction of certain performance conditions. The conditions are related to absolute compounded total shareholder return (TSR) increase between the Annual General Meeting 2024 and Annual General Meeting 2027, Camurus’ revenue growth, where the revenue (as reported) for the financial year 2023 is compared to the revenue (as reported) for the financial year 2026, and the company’s pipeline progress during the financial years 2024 (June)-2027 (May). The maximum dilution effect of the program is approximately 0.42 percent of the shares and votes in the company.

Fore more information about the respective program, see table below: